Rachel Cruze, financial expert and bestselling author, joins us to talk about Biblical principles for financial wisdom. Rachel shares truth and encouragement for the woman who has tied her worth to her financial status and shares the 7 Baby Steps to financial freedom. She reflects on how what we believe about money, ourselves and our world shapes our lives and tackles some of the limiting beliefs many women have around money. Be empowered to take control of your finances so you can become debt free and use money as a tool to be generous and live the kind of life you desire. Grab today’s show notes here.

—

Listen to the podcast here:

Becoming A Financially Wise Woman — With Rachel Cruze

We are a movement of women who are walking in our God-given identity, value and purpose. I’m so glad you are here. Let’s dive into our conversation.

—

Rachel, welcome back to our community here. How are you?

I’m doing great. Thanks so much for having me. I appreciate it.

We had you on the show a few years ago to talk about your other book. It’s great to have you back here. You are a number one New York Times bestselling author, a financial expert, the host of The Rachel Cruze Show. Growing up as Dave Ramsey’s daughter, you say that you hated budgeting for years. I’m curious, how did you end up becoming a financial expert yourself?

There are elements of what I teach now that were hard for me. I’m a natural spender. I always tell people, “You either spent towards saving or spending.” I always loved spending. I’m more of a free spirit and details can be a little tough. On a total side note, I made homemade cookies and screwed it up. I dumped it in the trash and was so mad. I looked at my husband and I was like, “Why can I not just read directions and look at details? I screw the cookies.” That’s me in a nutshell. When it comes to personal finance, the idea of tracking stuff, keeping up, looking at investments and numbers, none of it sounded enjoyable. It sounded constricting.

I feel like I had to say the word no a lot to myself if I was going to live on a budget. I had all these misconceptions. What I realized early on is that number one, I enjoyed public speaking. I traveled with my dad in high school and did some of that. I loved it. When I went to college, I realized, “People are hurting already at 18, 19, 20 years old. They are making these decisions that are going to hurt themselves financially soon in the future from credit cards, student loans, and all of that.”

You’re either bent towards saving or spending.

All of that combined, I had this heart and a little bit of this idea with public speaking and I’m like, “I can combine the two and help people but I don’t like details and I love to spend money. How is this going to work?” I realized number one, living on a budget is not what I thought it was. It is giving yourself permission to spend. I looked at it more as a tool for spending than a tool for saying no to myself all the time even though you have to say no sometimes. I reframed the way I looked at some of the principles that were tough for me and my natural personality.

Coming into play, I was like, “It has been so fun,” because I have been able to do that, and then take my real-life experience of being married, having three kids, and I’m working. Doing all of this together and helping people navigate the day-to-day when it comes to their life and their money, honestly, how did I become a financial expert? Living my life and being honest with people about where I’m at and what I’m learning is what’s brought me here.

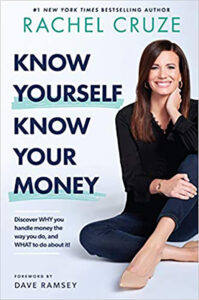

I finished over Christmas your book, Know Yourself, Know Your Money. It’s filled with highlights and underlines. It empowered me to help me be more intentional about the way that I spend my money and to understand why I’m spending it in certain ways and to have more self-insight. After reading it, I feel a lot more empowered than maybe I ever have about my own finances. We have a lot to talk about in this episode. Our conversation is about becoming a financially wise woman. What are some basic biblical principles for financial wisdom?

There’s a lot. It’s interesting when you look at scripture, there is more scripture specifically on money than heaven and hell combined. It’s all through it. When you look, you can definitely see some patterns of what is wise and what’s not. A lot of this stuff is not layered with sin. It’s not like, “You have student loans so you are a sinner. You’ve got to confess.” It’s, “There’s wisdom in it.” I love that you are using that word not necessarily a sin or not. It is, “What’s the wisest way to live? What’s the way to live with money that gives you less stress, more control, and ultimately, managing what God has given you well?” He’s given us things to steward and manage. We want to do that well.

A couple of those principles, number one for Ramsey Solutions is the importance of getting out of debt. You look at debt and every time it’s mentioned in scripture, it’s in a negative fashion. Being able to live debt-free, where you don’t owe anyone anything, there’s a power in that. It causes delayed gratification on your end because you may have to wait and save up for that thing or vacation you want to take instead of charging it on a credit card.

It forces you to look at different options but at the end of the day, there are some sacrifices on your end to stay debt-free. The result of it is that you have more freedom, not just financially but spiritually, emotionally. There’s so much when you do not have debts that free you up to live your life. There’s such power in that.

Know Yourself, Know Your Money: Discover WHY you handle money the way you do and WHAT to do about it!

Budgeting, we talked about that earlier but it is so true. Being able to be intentional with where your money goes. When Jesus talks to the disciples about the cost of being a disciple, he uses money as an example to say, “You are not going to build a tower without first counting the cost because if you start building it halfway up and you are not able to finish, everyone around is going to mock you.” This idea of, “You have to know what you have.” There’s a power in that to plan out your money and that’s what a budget is. That’s a huge principle.

Contentment is an emotional principle but godliness with contentment is great gain. There is a contentment piece to our culture that we are missing often. We use money or shopping as a band-aid. We put these things in our lives to think that we are going to be content but it’s not. It’s empty. Finding this godliness with contentment is such a big piece.

Obviously, there’s so much in giving when scripture talks about it but the idea of God owns it anyways. When you are giving and living life with open hands, there is a joy that sets in because money is not over you and controlling you when you say, “I’m going to live with open hands with this.” Money is going to leave. Honestly, that gives more opportunity for some more to come back in versus just holding tight.

There’s a beauty when it comes to giving selflessness that comes with that. We could spend all day on all these principles but there’s a lot in there. The wisdom that comes with it gives a level of peace in your life to a subject like money. That’s not peaceful for a lot of people. It creates a lot of anxiety. It’s a beautiful gift that God’s given us a playbook on how to handle this.

What I appreciate so much about your dad and your team is that you have taken this biblical wisdom about money. You have made it practical and able to be implemented in our lives. The resources you have are amazing and life-changing for many people. I love hearing the famous Debt-Free Scream and that’s great. You say that money is a tool and it has nothing to do with your identity. Can you share more about this?

Money is an interesting part of our lives because it’s the one thing that has a score to it. It has a number to it. I can sit here and tell you, I’m struggling when it comes to motherhood. There’s not a number to that or I could say in my marriage, we are rocking it. We are killing it in the marriage game. There’s not a number. With money, there is a number.

Contentment is an emotional principle, but godliness with contentment is great gain.

You are looking at a number, whether there was a negative in front of it or not. This idea that our net worth has become our self-worth in our world nowadays. It’s dangerous. We have to separate the two to say, “The mistakes I have made with money or even where I’m at doesn’t define who I am. It’s not this identity piece but it has become that so much.”

Separating the two is important for people because it’s that whole idea that, “I make mistakes. I’m not a mistake.” It is this way of looking at life and money. Money has become almost this God to a lot of people. It’s the end all be all, “If I could have this, everything is going to be fine. The only reason I work and do stuff is to have money.”

That brings in the bigger barns, the whole idea of it when Jesus is talking about that in the New Testament. There’s a lot to learn to separate the two, that money is not evil. It’s not wrong. Even if you have a lot, that’s okay. That’s not a bad thing. In fact, building wealth is awesome because you are able to be generous and help a lot of people but it’s not who you are. The distinction is important for people.

For any of our readers who aren’t yet familiar with The 7 Baby Steps to financial freedom, can you please give us an overview of them? Tell our readers where they can learn more and how they can start implementing these amazing baby steps? My husband and I have walked through them and it’s changed everything for us financially. Where they can learn more to?

I love this because it’s the plan. It is like, “Literally, this is what you do. Number 1, 2, 3, and 4.” It does give you an exact step of what to do. The very first thing you want to do is baby step one, a $1,000 emergency fund. We want you to do this in 30 days or less. Some people are thinking, “It’s $1,000? No worries.” Some people were like, “No. That’s a lot of money to find.” Whether that’s working extra, getting a part-time job, selling something, cutting back on even your taxes, stop investing. Finding ways to bring in $1,000 and to have it as your starter emergency fund is the baby step one.

Baby step two is getting out of debt, everything but your mortgage using the debt snowball. This is we are going to pay off all of your debt and you are going to do it by paying off the smallest amount first and working your way up. You are going to pay minimum payments on everything but pay off that smallest debt first. People who are doing that on average in 18 to 24 months are becoming completely debt-free.

Financially Wise Woman: There’s always some sacrifice on your end to stay debt-free, but the result is that you have more freedom, not just financially but also spiritually and emotionally.

After that, you will move on to baby step three, which is bumping up that starter emergency fund to 3 to 6 months of expenses. These are the intent steps. 1 through 3 is like game on. You are not going out to eat. You are sacrificing your lifestyle. You are not going on vacation or buying the brand new car that you wanted but you are doing nothing but putting all of your money towards these first three steps.

After baby step three, that’s the release of like, “I have no payments. I have a huge emergency fund. If another pandemic hits, we are okay. We have a whole nest egg over here.” It gives you this level of peace, which is amazing. You move on to baby steps 4, 5 and 6. You are going to do these at the same time. Baby step four is you are going to fund 15% of your income into retirement.

Baby step five, if you have kids, start saving for your kid’s college. Maybe step six is if you have any money left over, you are going to throw it and pay off the home early. On average, we are finding people are paying off their homes in around nine years. Once your house is completely paid off, your fund and retirement, you are continuing to do this but you get to move on to baby step seven, which is to build wealth and be extremely generous.

It’s a lot. It can seem overwhelming but how they are laid out in steps and how your teams share many stories of people going from hundreds of thousands of dollars in debt to being financially free. This is possible. If you are reading and you are like, “I’ve got all my student loans. I’m $40,000 in debt,” you can do this. You can be debt-free, wealthy, generous, and live with financial freedom. What are some of the limiting beliefs do you think women have around money?

Thank you for encouraging the reader because I would echo exactly what you said. It can feel overwhelming. You can go online. Google Ramsey Baby Steps. You can find all of this free content online to help keep you motivated. For women specifically, I find two camps of women when I talk. Especially, in some circles, even in the Christian faith, they yield a lot to their husband. They say, “I’m going to let my husband take care of that. I’m home with the kids. I’m going to let him do it.” The level of respect and trust there are amazing. That’s great but I want you to work more as a team when it comes to this issue.

Even if you don’t feel like you are good at Math, there, you feel like, “I don’t know if he does all that.” On the logistical side, my husband pays all the bills. It was up to me to literally pay the bills like get in there and log in. We would have no lights and no water. I can’t even make homemade cookies by following directions. It would be a disaster.

When you are giving and living life with open hands, joy sets in because money is not over you and controlling you.

Winston’s strength is, “I’m going to execute our plan.” Our plan is made up with both of us sitting there saying, “Here’s the budget.” budget together and saying, “Here’s what we are going to do.” You both have a say in it. You both know. I was talking to some friends and we said, “Who spends more?” They were asking about this conversation.

One of my friends said, “I spend more because I’m buying everything for the house. I’m grocery shopping. I’m buying the toilet paper at Costco. I’m doing it all.” I’m like, “You may have a handle on what needs to be in the budget even more than he does, depending on your roles and where you are at.” For women in that camp, don’t just yield like a step in, be a team lock arms, and do it together. There’s another sector of women that I talk to that has a lot of fear around sharing money with their husbands. They say, “My mom was burned. She was a single mom. My dad left her and now she didn’t have any access to money.”

I have a lot of friends that their mom has said, “Don’t depend on the man. You need to have your own thing over here.” There’s a danger in saying, “I’m going to be independent in this part of our marriage,” because it ends up putting a wedge between you and your husband. This is more for married women but to say, “I’m going to have this thing over here.” What ends up happening is you avoid conflict because money can bring some conflict but it’s good as you have to work through it.

It can create this wedge of not having the unity that could be there without working as a team. I see those two, especially when it comes to women that are married. For those that are not, there are messages out there that it’s a guy’s thing. Even in the financial space, “I’m one of the rare females that has stepped into personal finance because it feels like a male-dominated industry from even a working perspective.”

That can get into women’s minds of, it can feel like they are a little bit more passive with it for some women. Engage this because no matter who you are, male or female, it doesn’t matter. Your organs don’t depend on if you are going to handle money or not. We all have to handle money to engage that process and don’t believe those lies that you are not good enough or anything like that. You have to step in and engage it.

What would you say specifically to the single, married, young woman or woman of any age who feels like she’s unworthy of generating a wealth of creating an income that is reasonable or even exceptional? What would you say to that woman who feels like she’s not worthy of financial freedom of having wealth?

Financially Wise Woman: You’re not going to build a tower without first counting the cost. If you start building it halfway up and you’re not able to finish, everyone around’s going to mock you.

That’s a lie. There’s a toxic message there that being male or female, that wealth in general and winning with money is a bad thing. A lot of people in some circles look down on that and somehow think that’s a sin because there is a lot of caution. When you do look at scripture and you read through money, there are a lot of yellow flashing lights, the rich young ruler, the build bigger barns.

When you look at a lot of parables and it’s Jesus being cautious with the subject because it can become our identity, he can’t overtake us. I would say to look to understand money as a tool and it can help a lot of people. What could the people of God do for the kingdom of God if they had no payments? If every Christian’s car payment went to a nonprofit? What could happen if all of our student loan payments, instead of going to Sallie Mae, were going to organizations to free people from human trafficking or getting clean water?

There’s power in what can happen. This would go for women or men out there that you are worthy and you have the ability to say, “I’m going to control what I’m doing with my money to help the kingdom.” When that’s your why, there’s a bigger why for you or even to change your family tree is a very noble why. There are a lot of things out there that are so good that a wise man leaves wealth from generation to generation. He leaves that legacy for his kids. It’s in Deuteronomy. There’s power in the idea of building wealth but using it for good. It’s not just to go and keep it all to yourself.

I love how you talk about a mindset shift, about the way that you personally changed the way that you saw budgeting, and the way that you see money in general as a tool. I want to read a great quote from your book that I love that I highlighted, and I want to talk more about this, “What you believe today decides your future. What you believe about money, yourself, and the world shapes how your life will unfold. Every single day, you have the power to make decisions that will move you forward financially or set you back. It’s up to you.”

There’s a beautiful gift called free will. There’s a level of freedom that we are given to make choices day-to-day. That gives you the option to say, “What am I going to do? Am I going to make decisions to push me forward and make wise decisions when it comes to my money or am I going to make decisions that are going to harm me in my future?” It’s very clear.

That’s not to shame people because we all make mistakes. It’s not this idea that we are going to be perfect at it. Our level of winning with money looks more like a roller coaster. It’s up and down because life is going to happen. There are going to be setbacks. You may even go back a baby step as you are working on the plan. That happens a lot because of life.

You make mistakes, but you are not a mistake.

Give yourself a lot of grace in it. When you wake up and you say, “I have the ability to make choices and I’m going to be intentional with those choices. I’m not going to just let life happen to me and sit here. I’m going to be proactive.” There’s a beautiful thing that we get. We get this option to make these choices in our lives. Giving people the power, especially women to say, “You get to own this,” is a beautiful thing and I love it.

Your readers or the majority of them, I would suspect, are believers because you put the spiritual overlay of it. It gives you that bigger why we are doing this. It’s not just for us. It will give you benefit. You will have peace. You will sleep through the night, not worrying about the bills. It will give you things for sure that are great gifts but the bigger thing is I get to make choices to change my life, family’s life, and other people’s lives.

We talk a lot here on the show about the agency God gives us and the freedom. This is another example of how we interact with money. God gives us freedom. It says in the Bible, “If you lack wisdom, ask for it and God will give it to you generously.” Friends, if you are reading this and you are like, “I don’t have financial wisdom,” ask God.

Ask him to show you how to live wisely with your money, how to become debt-free, build wealth, live generously. You have many resources. I’m going to ask you to share your website shortly but Rachel, if you could go back and give your younger self some words of wisdom, how old would she be and what would you say to her?

I would probably go back to my 21-year-old self. I’ve got married at 21. I’ve got married young. I was a little bit of an old soul but I had all these ambitions and dreams. I couldn’t wait to get out but I had a level of probably control issues of fear of, “What if?” I would say, “Rachel, you serve a God that loves you and he’s going to take care of you. It may not look exactly what you are thinking it’s going to look like in 10 or 15 years but it’s okay. Take a deep breath. It’s going to be okay.” That’s probably what I would tell myself.

Where’s the best place our readers can connect with you, with the Ramsey, tools, resources, and get a copy of your book?

Financially Wise Woman: Net worth has become equal to self-worth in the world today. You have to separate the two and realize that the mistakes you’ve made with money don’t define who you are.

You can go to RachelCruze.com. Everything is on there. I have a show, The Rachel Cruze Show. I also do a video version of it too on YouTube and Facebook. You can check that out. The book is anywhere books are sold and I’m all over social media. Instagram is my favorite. I have a love and hate relationship with Instagram. I’ve got to set myself boundaries.

I found and followed you. I saw that you offer some practical things and you serve the people in your community. There were some fun, humor, and practical tips. Can you also share the Ramsey Solutions website? There are many tools on there that I want our readers to be sure that they are exposed to.

The biggest thing we have is Ramsey+. This is our membership and it brings in EveryDollar, which is our budgeting app, the premium version that connects to your bank account. As you are starting a budget, this is the best tool. It’s an app on your phone. It’s wonderful. You also get all of our classes and that membership, the Financial Peace University and Smart Money Smart Kids. All of our video content lives in that membership. Make sure to check that out.

If you go to the website, there are real estate calculators, investment calculators, tons and tons of articles and content in there as well. I would love for you to buy and read the book and all of it, but there’s a lot of free stuff out there on the internet from our podcasts and tools. You can take that all out at RamseySolutions.com.

I definitely recommend your book. It is great. Thank you so much for being with us, for joining our community, and for paving the way to help other women find financial peace and freedom for all you do.

Thanks for having me on. I appreciate it.

—

Thanks so much for joining us. If you enjoy this episode, please share it with your friend and invite her to be a part of our community. You can become an insider and get a free guide we wrote just for you.

Important Links:

- Rachel Cruze

- Show – Past Episode

- The Rachel Cruze Show

- Know Yourself, Know Your Money

- Ramsey Solutions

- Debt-Free Scream

- The 7 Baby Steps

- YouTube – The Rachel Cruze Show

- Facebook – Rachel Cruze

- Instagram – Rachel Cruze

- Ramsey+

- EveryDollar

- Financial Peace University

- Smart Money Smart Kids

- Know Yourself, Know Your Money: Discover Why You Handle Money The Way You Do, And What To Do About It! – Amazon

About Rachel Cruze

Rachel Cruze is a #1 New York Times bestselling author, financial expert and host of The Rachel Cruze Show. Growing up as Dave Ramsey’s daughter, Rachel hated budgeting for years until she experienced the freedom of budgeting for herself. Rachel now shares fun, practical ways to take control of your money and create a life you love.

Rachel Cruze is a #1 New York Times bestselling author, financial expert and host of The Rachel Cruze Show. Growing up as Dave Ramsey’s daughter, Rachel hated budgeting for years until she experienced the freedom of budgeting for herself. Rachel now shares fun, practical ways to take control of your money and create a life you love.